When you establish a corporation, various back-office tasks arise. It’s especially crucial to confirm tax-related matters in advance, as many have strict deadlines.

目次

- 1 Tax Schedule for a Newly Established Corporation’s First Fiscal Year

- 2 First, you’ll need to submit various documents, such as the Notification of Establishment, to the tax office.

- 3 Deciding Executive Compensation

- 4 Payment of withholding tax

- 5 From the end of the year into the new year, you’ll need to handle year-end adjustments , statutory reports, and the depreciable asset tax return

- 6 Tax Filing and Payment

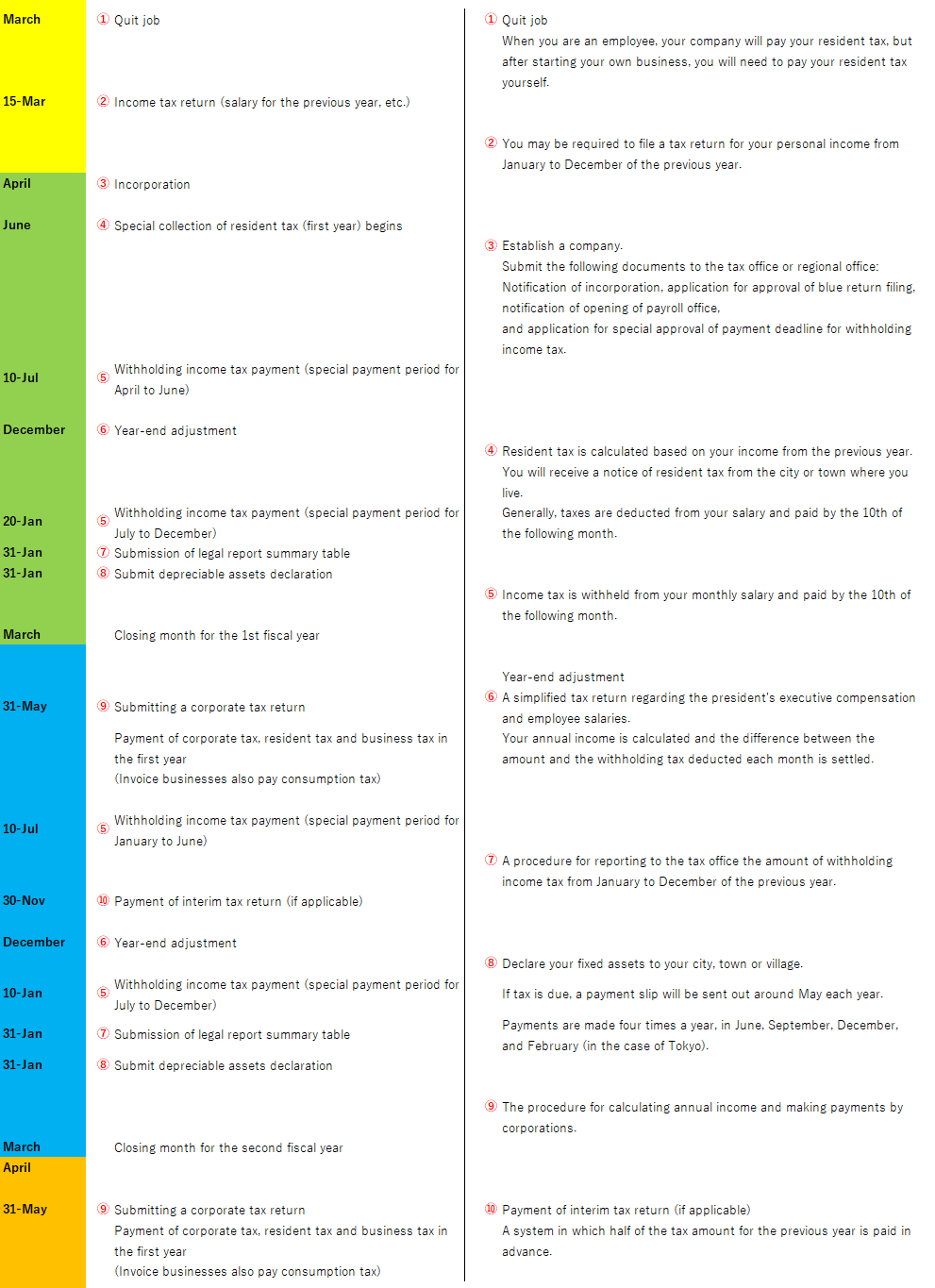

Tax Schedule for a Newly Established Corporation’s First Fiscal Year

When you establish a new corporation, here’s the tax schedule for your first fiscal year, assuming a March 31st year-end:

First, you’ll need to submit various documents, such as the Notification of Establishment, to the tax office.

Once you’ve established a corporation, the first step is to submit a set of documents, including the Notification of Establishment, to the tax office. There are quite a few of them, and their submission deadlines vary.

The “Notification of Establishment of a Salary Payment Office” (Item 3 below) has the earliest deadline. Therefore, it’s most efficient to submit all necessary documents at that time, ideally within one month of your company’s establishment.

Here are the key documents you’ll need to submit:

1. Notification of Establishment (法人設立届出書)

You need to submit this to the district tax office director within two months of the establishment date. A copy of your articles of incorporation, among other documents, must be attached. You’ll also submit similar establishment notifications to the prefectural and municipal offices.

2. Application for Approval of Blue Return (青色申告の承認申請書)

The deadline for this application is the day before the earlier of either three months after the establishment date or the end of your first fiscal year. Opting for the blue return status is highly recommended as it offers significant tax benefits.

3. Notification of Establishment of a Salary Payment Office (給与等の支払事務所の開設届出書)

This is required if you’ll be paying executive compensation or employee salaries. The deadline is within one month from the date you establish the salary payment office.

4. Application for Special Provisions for Due Dates for Withholding Tax (源泉所得税の納期の特例の承認に関する申請書)

If your company constantly employs fewer than 10 people, you can apply to pay withholding tax twice a year instead of monthly.

In addition to the above, if applicable to your corporation, you may also need to submit the following documents:

5. Application for Registration as a Qualified Invoice Issuer (適格請求書発行事業者の登録申請書)

6. Application for Extension of Filing Deadline (申告期限の延長の特例の申請書)

7. Notification of Inventory Valuation Method (棚卸資産の評価方法の届出書)

8. Notification of Depreciation Method for Depreciable Assets (減価償却資産の償却方法の届出書)

9. Notification of Method for Calculating Book Value Per Unit of Securities (有価証券の1単位当たりの帳簿価額の算出の方法の届出書)

10. Notification of Year-End Translation Method for Foreign Currency-Denominated Assets, etc. (外貨建資産等の期末換算の方法の届出書)

11. Notification of Method for Lump-Sum 計上 of Foreign Exchange Forward Contract Differences (為替予約差額の一括計上の方法の届出書)

12. Notification Regarding Pre-determined Compensation (事前確定届出給与に関する届け出書)

Deciding Executive Compensation

Executive compensation should be decided and paid within three months of your company’s establishment. Once set, the same amount is generally paid monthly for one year. Unlike a salaried employee, it’s not common for executive compensation to fluctuate each month.

Payment of withholding tax

For small corporations, withholding tax is paid to the tax office twice a year.

The payment deadlines are:

- July 10th for amounts withheld from January to June.

- January 20th for amounts withheld from July to December.

It’s crucial to be punctual with these payments. Even a single day’s delay in paying withholding tax will result in a penalty tax called a “delinquent tax on non-payment” (不納付加算税). Make sure you have a system in place to prevent any missed payments.

From the end of the year into the new year, you’ll need to handle year-end adjustments , statutory reports, and the depreciable asset tax return

From the end of the year into the new year, you’ll need to handle year-end adjustments, statutory records, and the depreciable asset tax declaration. Each of these has many points to consider.

If you run a one-person company with limited transactions, you can likely manage these tasks yourself. Joining an organization like a Corporate Association (法人会) can be beneficial, as they often offer workshops on year-end adjustments that you might find helpful.

Tax Filing and Payment

Generally, you’ll need to complete your tax filing and payment within two months of your fiscal year-end.

First, you’ll record all your sales, purchases, and expenses into accounting software. Many modern accounting software programs are user-friendly, so if your transaction volume isn’t too high, you might be able to handle this in-house.

Once your accounting figures are finalized, you’ll prepare your corporate tax return. It’s quite challenging to do this by hand, so using a corporate tax filing system is a more practical approach.

Our Services

- Tax advisory services, spot tax consultations, support for starting individual businesses and company establishment, and support for startup financing, among others.

- We can handle taxes related to overseas transactions, international taxation, and English support.

- Service areas: Primarily in Nerima Ward, Shibuya Ward, Toshima Ward, Suginami Ward, Nakano Ward, Shinjuku Ward, and Setagaya Ward, as well as the 23 wards of Tokyo,

Nishitokyo City, Mitaka City, Musashino City, and other areas outside the 23 wards of Tokyo, including Kanagawa Prefecture, Saitama Prefecture, and Chiba Prefecture.

Nagano Prefecture (due to being my hometown).

*We can also provide nationwide support using online tools.”

- The content of the blog on this site is written based on various laws and regulations at the time of writing, so the information provided may not necessarily be the most up-to-date.

- The content is presented under limited conditions, and some specialized topics have been avoided to make the articles more accessible to the general public. While we strive to enhance accuracy, the blog administrators will not be held responsible for any damages or disadvantages that may arise from the use of the information provided in the blog (including information provided by third parties).

- When making decisions regarding your own tax issues, please make sure to consult with your tax advisor and make your own judgments at your own responsibility.