When establishing a company in Japan, the first thing to consider is whether to form a Kabushiki Kaisha (KK) or a Godo Kaisha (GK). KK is more common in Japan, while GK is gaining popularity these days.

In conclusion, both types have their pros and cons, so it’s difficult to say which is better. Personally, I believe that GK has more advantages for sole proprietors and small companies.

目次

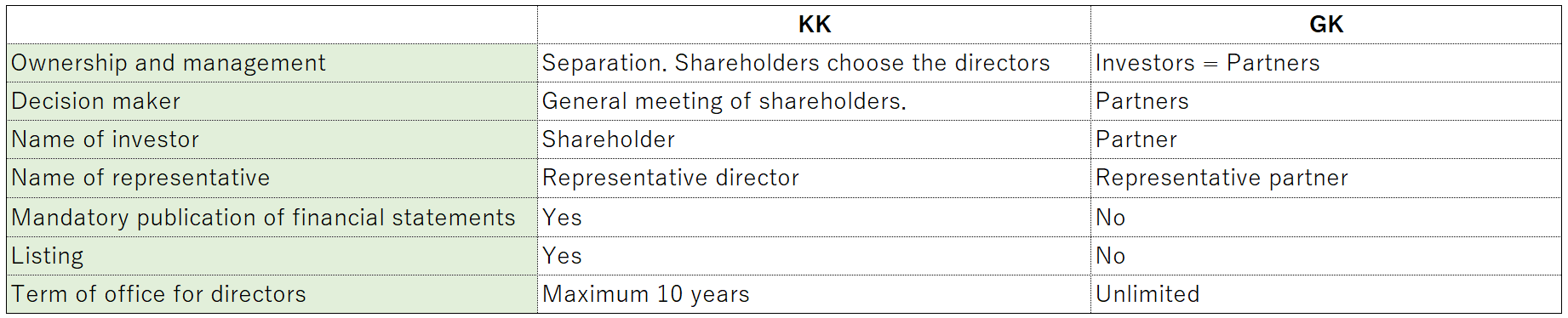

Comparison of the Characteristics of KK and GK

The key differences between KK and GK are as follows:

One important point to note is the “term of office for directors.” In the case of KK, the maximum term for directors is 10 years. This means that KK must be re-registered at least once every 10 years.

GK does not have this requirement. Therefore, if you intend to have a sole president or run a small company, GK is recommended.

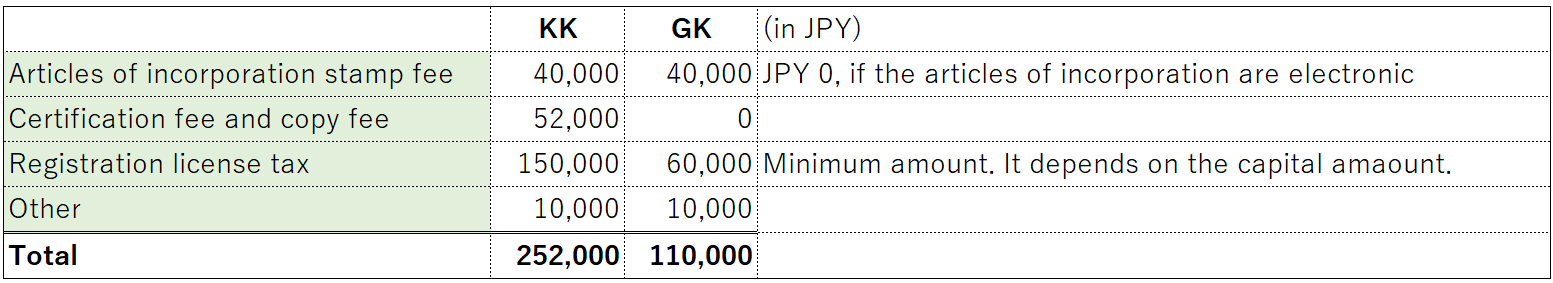

Comparison of Establishment Costs

In terms of costs, GK is more reasonable.

If you ask a judicial scrivener to set up your company, their fees will be added on top of the above-mentioned costs.

Points to Consider When Choosing KK

- You plan to take your company public in the future.

- You prefer the name “KK.”

- You want the title of “Representative Director” (代表取締役).

- You are considering raising funds from third parties.

Points to Consider When Choosing GK:

- You have no issue with the name “GK.”

- You want to reduce the establishment costs.

Industries that are suitable for GK are as follows:

- Specialized service industries (e.g., design, consulting, IT services, etc.)

- Beauty salons, retail stores, restaurants, dry cleaners, etc., are also suitable for GK.

Guideline from National tax Agency

You can also find useful information from the National Tax Agency’s website below.

https://www.nta.go.jp/english/index.htm

https://www.nta.go.jp/english/Guidelines.htm

Tokyo One-Stop Business Establishment Center

The Japanese government is putting effort into supporting foreign entrepreneurs. Please visit this website below for further information.

https://www.startup-support.metro.tokyo.lg.jp/onestop/en

Uehara tax accountant office collaborates with other professionals who speak English and provide comprehensive support for the establishment of your corporation.

Our Services

- Tax advisory services, spot tax consultations, support for starting individual businesses and company establishment, and support for startup financing, among others.

- We can handle taxes related to overseas transactions, international taxation, and English support.

- Service areas: Primarily in Nerima Ward, Shibuya Ward, Toshima Ward, Suginami Ward, Nakano Ward, Shinjuku Ward, and Setagaya Ward, as well as the 23 wards of Tokyo,

Nishitokyo City, Mitaka City, Musashino City, and other areas outside the 23 wards of Tokyo, including Kanagawa Prefecture, Saitama Prefecture, and Chiba Prefecture.

Nagano Prefecture (due to being my hometown).

*We can also provide nationwide support using online tools.”

- The content of the blog on this site is written based on various laws and regulations at the time of writing, so the information provided may not necessarily be the most up-to-date.

- The content is presented under limited conditions, and some specialized topics have been avoided to make the articles more accessible to the general public. While we strive to enhance accuracy, the blog administrators will not be held responsible for any damages or disadvantages that may arise from the use of the information provided in the blog (including information provided by third parties).

- When making decisions regarding your own tax issues, please make sure to consult with your tax advisor and make your own judgments at your own responsibility.