Tax filing in Japan is complex and challenging. However, if you are employed and have a side job, you are required to file individual tax returns.

You can find English-speaking tax accountants from the link below:

HP : https://www.fsa.go.jp/internationalfinancialcenter/en/multilingual-organizations

目次

Is It Necessary to Submit a Business Registration to the Tax Office?

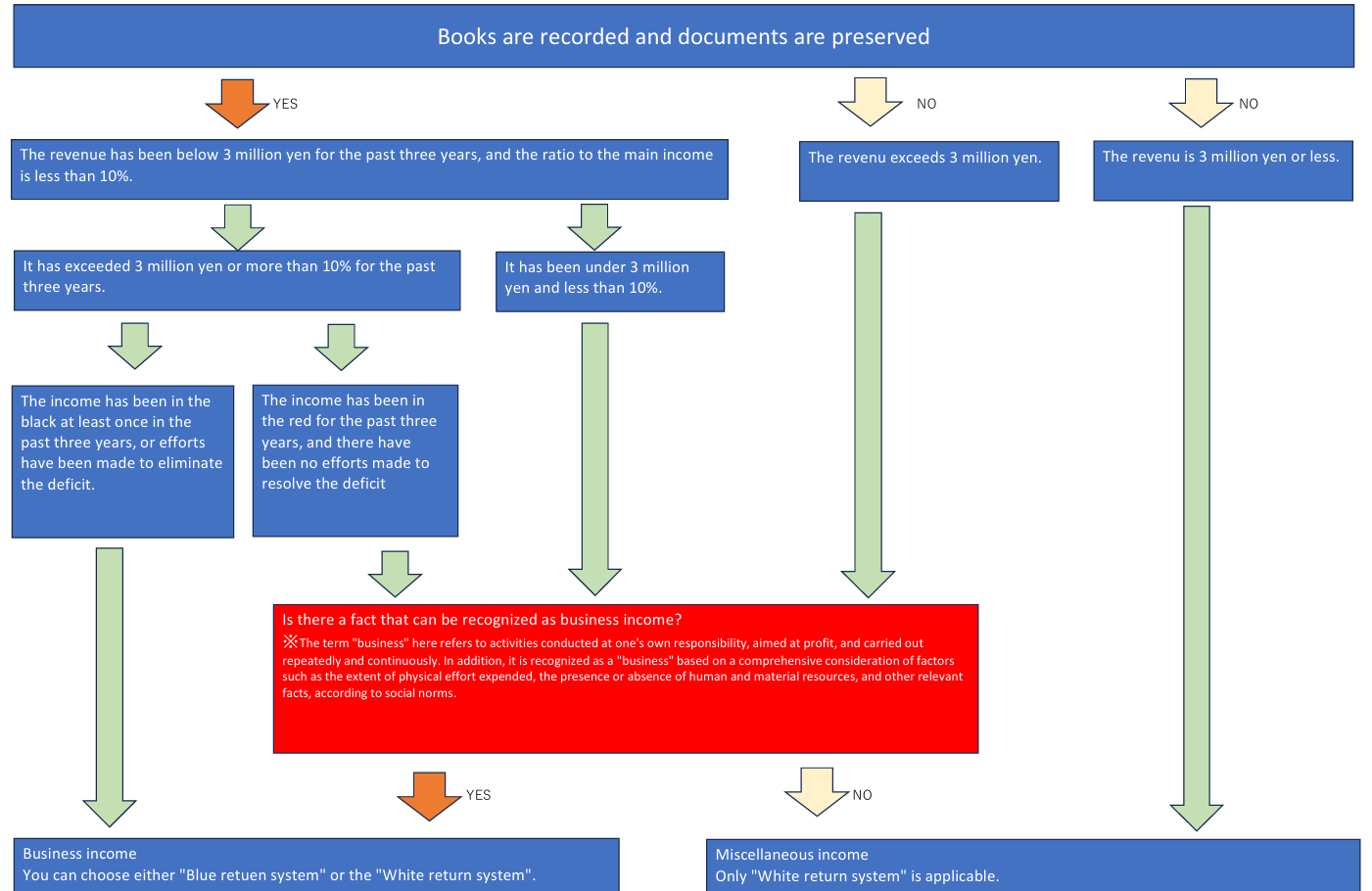

In the case of a side job, if your income is relatively low compared to your salary, you should file your tax returns as “Miscellaneous income.” You generally do not need to submit a business registration to the tax office.

If your side job grows in scale, you can file your them as “Business income.” For “Business income, you need to submit a “business registration” to the tax office. Additionally, by submitting an “Application for approval of blue return,” you can enjoy various tax benefits. The National Tax Agency has also published methods for filing tax returns by yourself.

HP : https://www.nta.go.jp/taxes/shiraberu/shinkoku/tebiki/2023/pdf/061.pdf

Please refer to this flowchart for determining “Miscellaneous income” and “Business income.”

Reference : https://www.town.otaki.chiba.jp/kurashi/zei/7/1095.html

What Documents Are Required?

The main documents required for your tax return filings are as follows:

- My Number information

- Tax withholding statement from a company you work for

(For full-time workers, it’s called gensenchoshuhyou 源泉徴収票 in Japanese.)

(For freelancers, it’s called shiharai chōsho 支払調書 in Japanses.) - Documents related to revenue for your side job

- Invoices and receipts for all deductibles

This is broad and can include all expenses related to your work.

For example, if you work from home, you can deduct some portion of your rent and utility bills. - Your banking information and/or bank statement

When Should You File Your Tax Returns?

Your tax liabilities are calculated based on the calendar year (i.e. From 1st January to 31st December). The filing period is from February 16 to March 15 of the following year. The individual tax payment must be made by March 15. If you set up automatic bank transfers, the tax will be withdrawn from your bank account in late April.

Additionally, the resident tax payment notice will arrive around May. Payment can be made at bank counters, convenience stores, or through online banking. It is important to note that the individual tax and the resident tax are paid separately.

While you can handle your tax returns for your side job on your own, it can be time-consuming and labor-intensive. Therefore, consider consulting with a Japanese tax accountant who can communicate in English.

Guideline from National Tax Agency

You can also find useful information from the National Tax Agency’s website below.

https://www.nta.go.jp/english/index.htm

https://www.nta.go.jp/english/Guidelines.htm

Tokyo One-Stop Business Establishment Center

The Japanese government is putting effort into supporting foreign entrepreneurs. Please visit this website below for further information.

https://www.startup-support.metro.tokyo.lg.jp/onestop/en

Uehara tax accountant office collaborates with other professionals who speak English and provide comprehensive support for the establishment of your corporation.

Our Services

- Tax advisory services, spot tax consultations, support for starting individual businesses and company establishment, and support for startup financing, among others.

- We can handle taxes related to overseas transactions, international taxation, and English support.

- Service areas: Primarily in Nerima Ward, Shibuya Ward, Toshima Ward, Suginami Ward, Nakano Ward, Shinjuku Ward, and Setagaya Ward, as well as the 23 wards of Tokyo,

Nishitokyo City, Mitaka City, Musashino City, and other areas outside the 23 wards of Tokyo, including Kanagawa Prefecture, Saitama Prefecture, and Chiba Prefecture.

Nagano Prefecture (due to being my hometown).

*We can also provide nationwide support using online tools.”

- The content of the blog on this site is written based on various laws and regulations at the time of writing, so the information provided may not necessarily be the most up-to-date.

- The content is presented under limited conditions, and some specialized topics have been avoided to make the articles more accessible to the general public. While we strive to enhance accuracy, the blog administrators will not be held responsible for any damages or disadvantages that may arise from the use of the information provided in the blog (including information provided by third parties).

- When making decisions regarding your own tax issues, please make sure to consult with your tax advisor and make your own judgments at your own responsibility.